About Super73

Founded in 2016 and based in Irvine, California, Super73 started as a Kickstarter crowdfunding campaign with a $25,000 fundraising goal. A nostalgic design that made the bike look more like a cafe racer motorcycle, and a viral video campaign managed to secure over $441,000 from backers. As of today, the company produces several models, ranging from commuter-oriented to full suspension, off road going models.

Most popular Super73 models

Super73 has 3 distinct model lines: S line comprises simple S1 and a more powerful S2. The R line includes two very capable full-suspension bikes, R and the upgraded RX. The Z line features simple and modern looking Z and ZX bikes with lightweight alloy frames, and mechanical disc brakes.

S1 is the original offering from Super73 and it still is very popular. It has everything you need and nothing you don’t: it has a simple frame, front suspension, a comfy seat, and no shifters. What you get is a raw, powerful e-bike that can take you to work and back the long way, with a smile on your face.

Coverage from: $11.00/mo

Get a free quote

S1’s big brother, it is driven by a brushless motor with a 2,000 watt peak output and a 960 watt-hour battery. S2 features an improved, larger seat, integrated headlight, twist throttle and 4 piston disc brakes.

Coverage from: $15.00/mo

Get a free quote

Sometimes, simpler is better, and the Super73 Z is a perfect testament. It comes with a 500 watt nominal, 1,000 peak power hub motor, an integrated 417 watt-hour battery, a rigid fork, and mechanical disc brakes.

Coverage from: $8.00/mo

Get a free quote

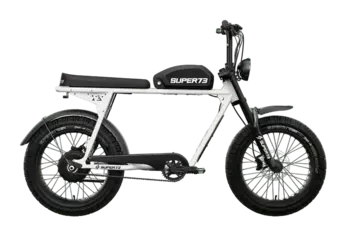

This BMX-inspired bike comes with a lightweight aluminum frame, a removable 615 watt-hour battery and a 750 watt nominal, 1350 watt peak power motor. The bike has an upright seating position, and is configurable via bluetooth using a mobile app.

Coverage from: $11.00/mo

Get a free quote

Riding on 20 inch fat all-terrain tires, this go-anywhere e-bike oozes quality and design. It can operate in Class 1, 2, and 3 modes, so it can be ridden on bike trails and go offroad, in Unlimited mode which provides 1,200 watts of normal and 2,000 peak power, enough to propel you up the steepest of hills.

Coverage from: $12.00/mo

Get a free quote

Instantly recognizable as a Super73, RX is equipped with a 960 watt-hour battery that gives it 38 miles of range in the most motor-assisted of the four power modes. If you wanted to hyper mile this bike, you’d get 75 miles of range in the full pedal assist mode.

Coverage from: $11.00/mo

Get a free quoteWe cover all types of bikes

Whether you ride the tarmac or shred the gnar, dodge pedestrians, or cruise the beach, you're a member of a special club of people who appreciate the world in a primal way – on two wheels. To keep you rolling, we address the specific risks associated with your discipline.

Coverages and Features

Velosurance offers must-have protection such as accidental damage, theft, or loss in transit. Each policy can be customized by adding additional coverages such as liability protection, uninsured motorist, and medical payments.

Total loss by theft

Bicycles are very easy to steal and equally difficult to recover, and even a hefty U-lock doesn’t guarantee your bike is still there when you return. Velosurance provides peace of mind if it is stolen or damaged in the process.

Any crash or accidental damage

Our policy will pay to replace your ride if it is accidentally damaged and beyond repair, including damage that occurs while being carried on or in your vehicle. If it can be repaired, we will pay all the costs associated with the bike's repair, including tax, labor, and shipping, minus the deductible. Cosmetic damage that does not affect safety is excluded.

Our shop or yours

When filing a claim, you’ll need to provide a repair estimate from a repair shop. We have a nationwide network of partner shops familiar with our process to help you move things along quickly. Prefer your favorite local shop? That works too.

Gear and apparel

If you go down in a crash, we cover your ride as well as your apparel, such as helmet, shoes, glasses, or riding kit that are torn up, and pay up to $500 per accident and $1,000 per term. Spare parts that are not installed, such as a spare wheelset, are also covered up to $500 per loss and $1,000 per year.

Your choice of lock

We do not dictate what type or brand of lock must be used to protect your ride from theft – you are welcome to use any lock that you trust. The best security is provided by metal locks combined with a high-quality chain. Securing your ride to a solid and immovable object, such as a bike rack, with a high-quality lock will send the thief onto the one secured with a more vulnerable lock.

No depreciation

Depreciation is a hidden deductible that increases every year and is applied if the bicycle is stolen or totaled. No one is ever happy with an Actual Cash Value insurance settlement: the bike is first devalued, and then a deductible is applied, resulting in a reimbursement that is far less than the cost of a replacement. We reimburse without depreciation, for the cost of a replacement that is of like, kind, and quality similar to your totaled bike.

24/7/365 coverage

We cover the insured bike at all times, anywhere in the USA and Canada, and can be extended worldwide on request. There are no exclusions on the time of day or limitations on how long it can be stored away from home. 24/7/365 means every minute of every day, no matter where or when.

Standalone policy

Our policy does not piggypack on any coverage you may already have, such as homeowners policies. Filing a claim won’t impact your rates with other carriers. With home insurance premiums rising each year in the U.S., it’s wise to reserve that policy for major incidents, because no matter how valuable your bike is, it’s still a lot cheaper than a kitchen fire or a flooded basement.

Permissive use

You can lend it to anyone you choose, and it will be covered. The bike and the person riding it are covered as if it were you riding it‚ this includes theft and crash damage as well as any purchased optional coverages.

Why Velosurance is best for your bicycle

Not all types of insurance are created equal. Velosurance levels the playing field by offering stand-alone bicycle coverage, where claims won’t affect your homeowner's or renter’s policy premiums.

| Policy Coverage |  | Homeowner/Renters Policy |

|---|---|---|

| Insured at Full Value | Yes | Possibly |

| Crash Damage | Yes | No |

| Theft Coverage | Yes | Limited |

| Theft by Force | Yes | No |

| Theft of Accessories | Yes | Limited |

| Theft Away From Home | Yes | Possibly |

| Vehicle Contact | Yes | No |

| Personal Liability | Yes | Possibly |

| Permissive Use Policy | Yes | No |

| Replacement Rental | Yes | No |

| Event Fee Return | Yes | No |

| Cycling Apparel Coverage | Yes | No |

| Medical Payments | Yes | Possibly |

| Racing Coverage | Yes | No |

| E-bikes | Yes | No |

| Coverage in-transit | Yes | No |

| USAC, USAT and IMBA Member Discount | Yes | No |

| FREE INSTANT QUOTE |

Not all insurance policies provide the same level of protection, and many people only discover gaps in their coverage after filing a claim. We’ve done the hard work of reviewing the fine print. To see how plans compare, check out our insurance comparison.

Client satisfaction is our #1 goal. Here's what our clients say about Velosurance

Check out Velosurance reviews to see what people are saying about us.

Contact Us

'Convinced yet? Let's make something great together.

If you have any questions, don't hesitate to get in touch with us.'

America's best bicycle insurance

Velosurance was created to give our fellow riders insurance that actually covered their lifestyle and peace of mind that no matter what happens on the road or trail, there would be a helping hand to get them back in the saddle.